In the past year, I co-founded a startup called Desert Lion in the dev tools industry. Unfortunately, we struggled to attract customers and recently closed the business.

Our goal was to provide developers with enhanced monitoring and debugging capabilities for their front-end applications. As part of my role, I extensively researched the developer tools market to understand it better and determine our unique selling point.

One thing I learned: while there is so much technical content online around developer tools, there are not enough good business resources on them.

To fill this gap, I turned to public companies' quarterly reports for valuable insights. I began reading these reports and attending earnings calls of companies like DataDog, Dynatrace, and Twilio.

Despite the closure of my company, I remain passionate about the market. Therefore, I created The Developer Tool Index to continue being involved in the industry.

If you’re a developer, tech entrepreneur, investor, industry analyst, or just a tech-savvy person, this newsletter is for you. It will be delivered weekly and focus on tracking an index of publicly traded developer tools.

Subscribe to get the next edition.

In the newsletter, we will delve deep into companies' financial performance, explore the competitive landscape, analyze market behavior, and provide valuable insights. Our aim is to equip you with the necessary information to make informed decisions in this industry.

All the index data will be available through the dashboard at developertoolsindex.com.

However, it is important to note that I am not a financial expert. I still have much to learn, and sharing this journey publicly will make it even more enjoyable.

A brief overview of the developer tools market

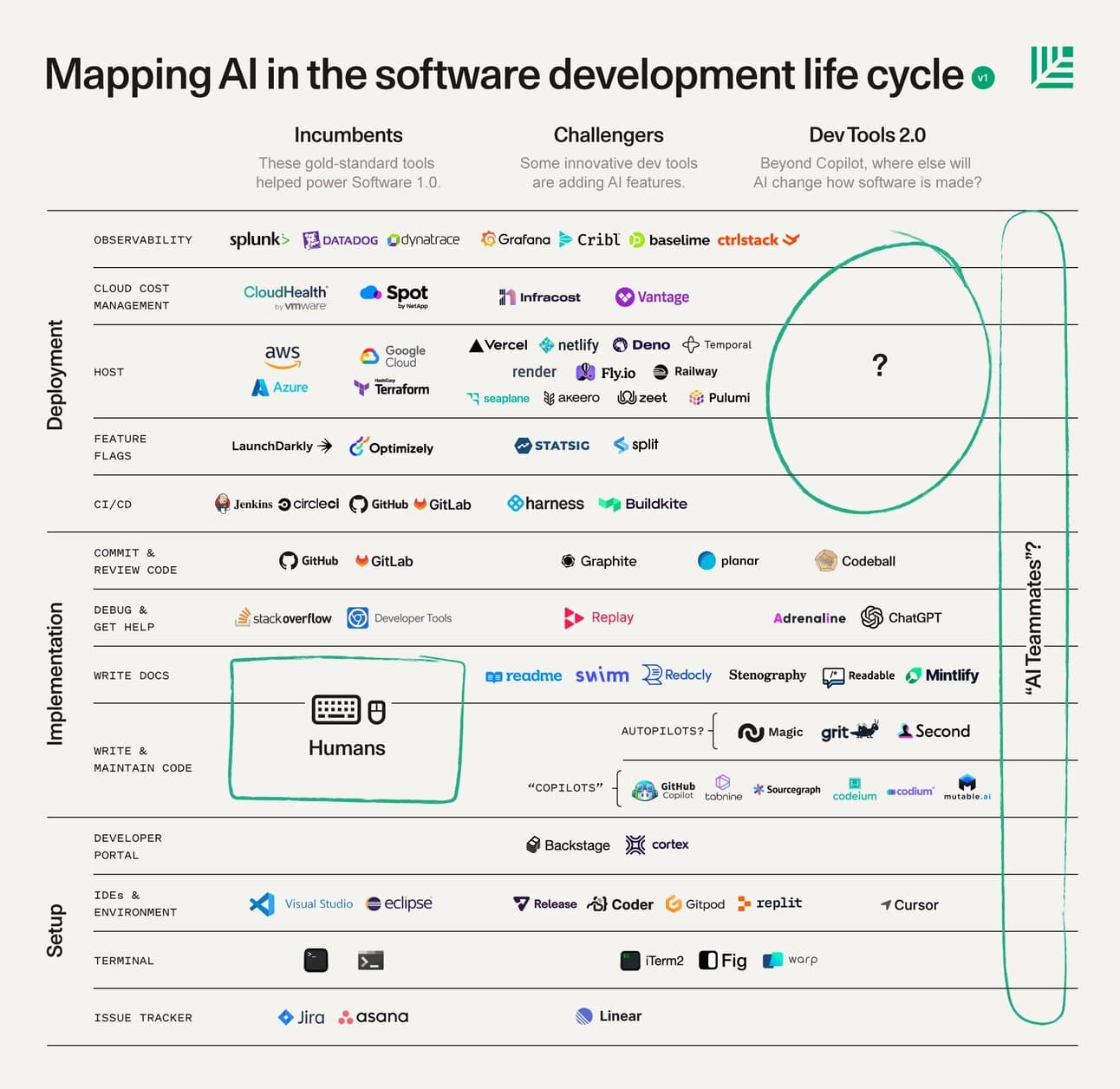

Developer tools, in simple terms, refer to the tools developers employ in software creation. These tools form an integral part of the software development life cycle (SDLC) and serve as the fundamental building blocks for software development.

Examples of companies in the space are MongoDB, Cloudflare, and Twilio. According to Statista, the Application Development Software Market Revenue is US$167bn annually.

The rise of the developer class has driven the developer tools market. As Yang Tran from Speedinvest wrote:

There are roughly 27 million software developers worldwide and that number is predicted to grow by more than 60% to 45 million in the next ten years.

- Yang Tran, Speedinvest

Jean Yang from a16z elaborated in her piece The Case for 'Developer Experience':

We’re now seeing the rise of developers as buyers, as influencers, and as a creative class. Developers are increasingly the decision-makers when it comes to choosing the tools and technologies they use.

- Jean Yang, a16z

Developers are increasingly becoming the decision-makers when it comes to choosing the tools and technologies they use.

Sub Categories

There are endless sub-categories in the developer tools market. Each category has different moats, user behavior, and landscapes.

These are a few sub-categories:

-

Databases

-

Cloud Providers

-

API’s

-

Observability & Monitoring

-

DevOps Tools (Developer Operations)

-

Cybersecurity

-

CI/CD operations

-

Platform as a Service (PaaS)

In the developer tools index, we will see how each category performs as well.

Effects and Trends In the Market

Several key factors shape the developer tool market:

-

The Cloud

-

Smartphones

-

AI Advancements

-

COVID-19 and Remote Work

-

Edge Computing

-

Low/No-Code tools

-

Security & Privacy trends

-

Open-Source

The dominant business model in this sector is the Software-as-a-Service (SaaS) model. However, open-source culture is also very popular, with some companies like Jfrog and GitLab making their core business freely available to the public, a phenomenon we'll explore in more detail later on.

Developer tools, at a high level, are categorized within the Technology sector in stock exchanges. Our index will concentrate on companies listed on Nasdaq.

Introducing the Developer Tools Index

As I said earlier, I’m not a finance expert at all. There are some gaps I need to fill on how to create an index fund and track it.

According to Wikipedia:

An index fund (also index tracker) is a mutual fund or exchange-traded fund (ETF) designed to follow certain preset rules so that the fund can replicate the performance ("track") of a specified basket of underlying investments.

- Wikipedia

I have no plans to offer investment opportunities in our index or ETF. Instead, I will focus on providing sector news coverage, extracting valuable insights, delving into company performances, and monitoring trends.

Another great resource was the “How the S&P 500 is calculated” video from the Financial Times Charts that Count series.

How The Index Works

The index will serve as a key indicator of the performance of the developer tools market.

This is a starting point for our index process, but since we are dealing with software companies, we’ll keep it agile. We will change and adapt our process based on feedback and market changes.

Structure

The index will be composed of 20 developer tools companies. I’ve already collected 40 candidates, and we will filter the list with the selection criteria we’ll introduce next week.

You can already check the candidates in the index dashboard.

Each company will be weighed within the index, calculated based on its market capitalization. This provides a more nuanced picture of the market than equally weighing each company.

Value

We’ll track the value in each of the newsletter editions. It’s the north star of the developer tools market.

Our index value is calculated as the sum of each company's market capitalization, which is the product of the share price and the quantity of publicly available shares. This value is calculated at the end of each trading day based on the closing market prices of the company’s stocks.

Therefore, the index value reflects the combined performance of the developer tools sector represented by the companies within the index.

Price

The index price is calculated by: a weighted average of the companies' share prices in the index. This weighted average would take into account the market capitalization of each company.

Dashboard

All of the data will be available through the index dashboard.

I created the first version of it, and it’s already available with the 40 candidates we selected, including the index price and market cap. It’ll be realsed as an open-source project as well - It’s built with Next.js, Tremor, and Finnhub for financial data.

Next Week

Next week, we will define the index selection criteria and select the 20 companies that’ll be part of the index.

In the meantime, feel free to explore the dashboard I created with all the candidates, their stock prices, and their market cap!

I hope you enjoyed it. Subscribe here to get next week's update.

Who I Am: I’m a previous founder and a software consultant passionate about software and software businesses. I’ve been a software engineer for seven years and a consultant for the last three. I’m currently part of a great team at Bonfire and Leading the Front-End Guild at a.team.